Published: November 9, 2025

What is the 8th Pay Commission?

The Government of India has officially constituted the 8th Central Pay Commission (8th CPC) to review and recommend changes to the salary structures of central government employees and pensioners. The panel is chaired by Justice (Retd) Ranjana Desai and will submit its report within 18 months. Implementation is expected from January 1, 2026. Key updates include revised fitment factors, a new pay matrix, and crucial changes for pensioners and family pensioners.

Latest News & Key Points

- The 8th CPC will affect nearly 50 lakh employees and over 65 lakh pensioners across India.

- The expected implementation date is January 1, 2026, with recommendations anticipated in late 2025.

- The fitment factor is expected to range between 1.96 and 2.86.

- Minimum basic pay is likely to increase from ₹18,000 (7th CPC) to ₹35,280–₹51,480 (estimated 8th CPC).

- Pensioners are seeking inclusion within the new terms, as advocacy groups petition for their coverage in the final recommendations.

- Allowances, including Dearness Allowance (DA), House Rent Allowance (HRA), and Travel Allowance (TA), will be recalculated based on the new basic pay structure.

- Projected salary hike: 30–34% for most central government employees.

8th Pay Commission Salary Calculator

Expected Revised Salary Formula:

New Gross Salary = (Current Basic Pay × Fitment Factor) + DA + HRA

Example Calculation (assuming DA is 0%, HRA is 30%, Fitment Factor is 2.5):

If current basic pay is ₹30,000:

New Basic Pay = 30,000 × 2.5 = ₹75,000

HRA = 30% × 75,000 = ₹22,500

Total Revised Salary = ₹75,000 + ₹22,500 = ₹97,500

Fitment Factor Projections: 1.96, 2.5, 2.86

8th Pay Commission Salary Calculator

Enter your current basic pay and select the expected fitment factor to calculate your estimated revised salary.

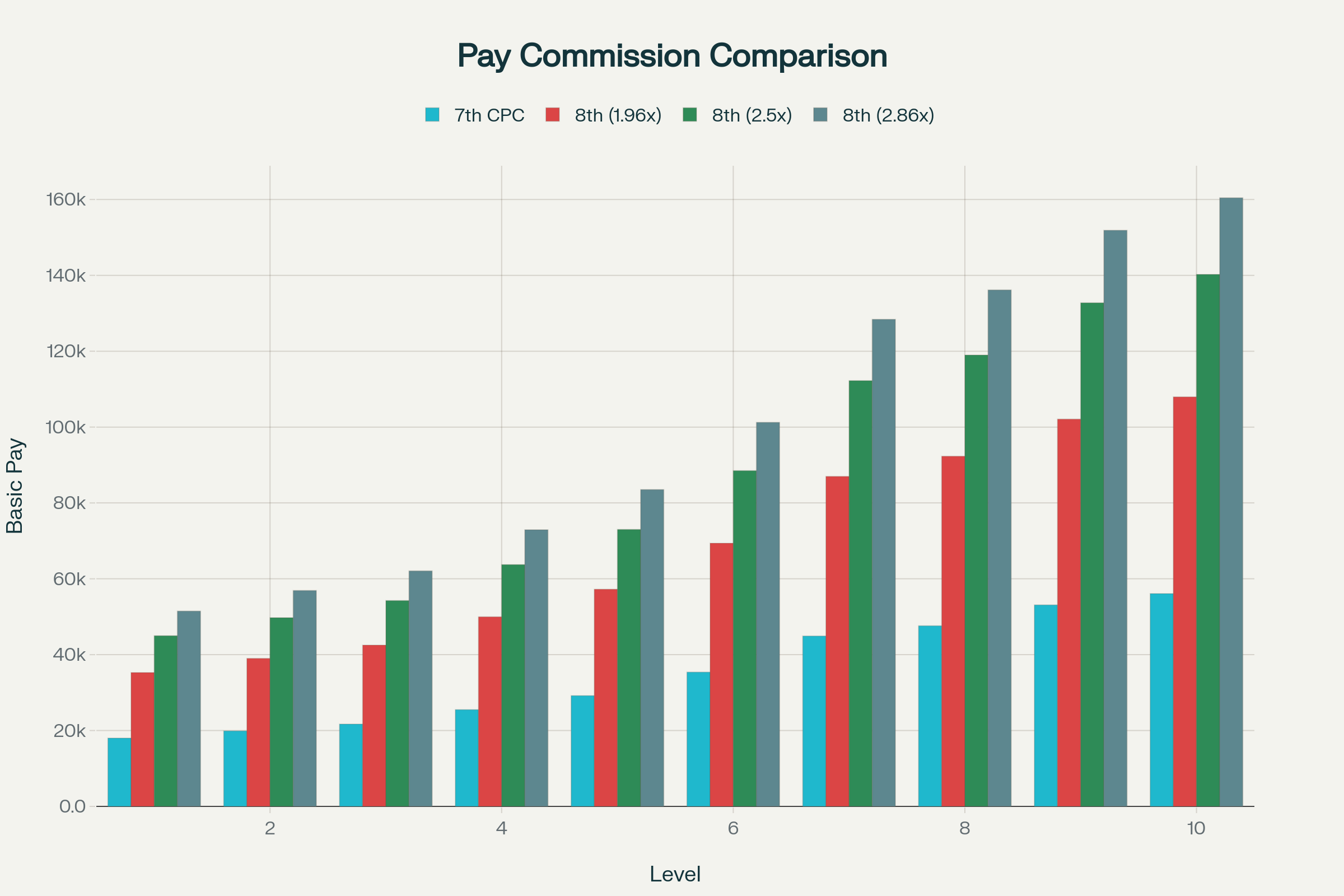

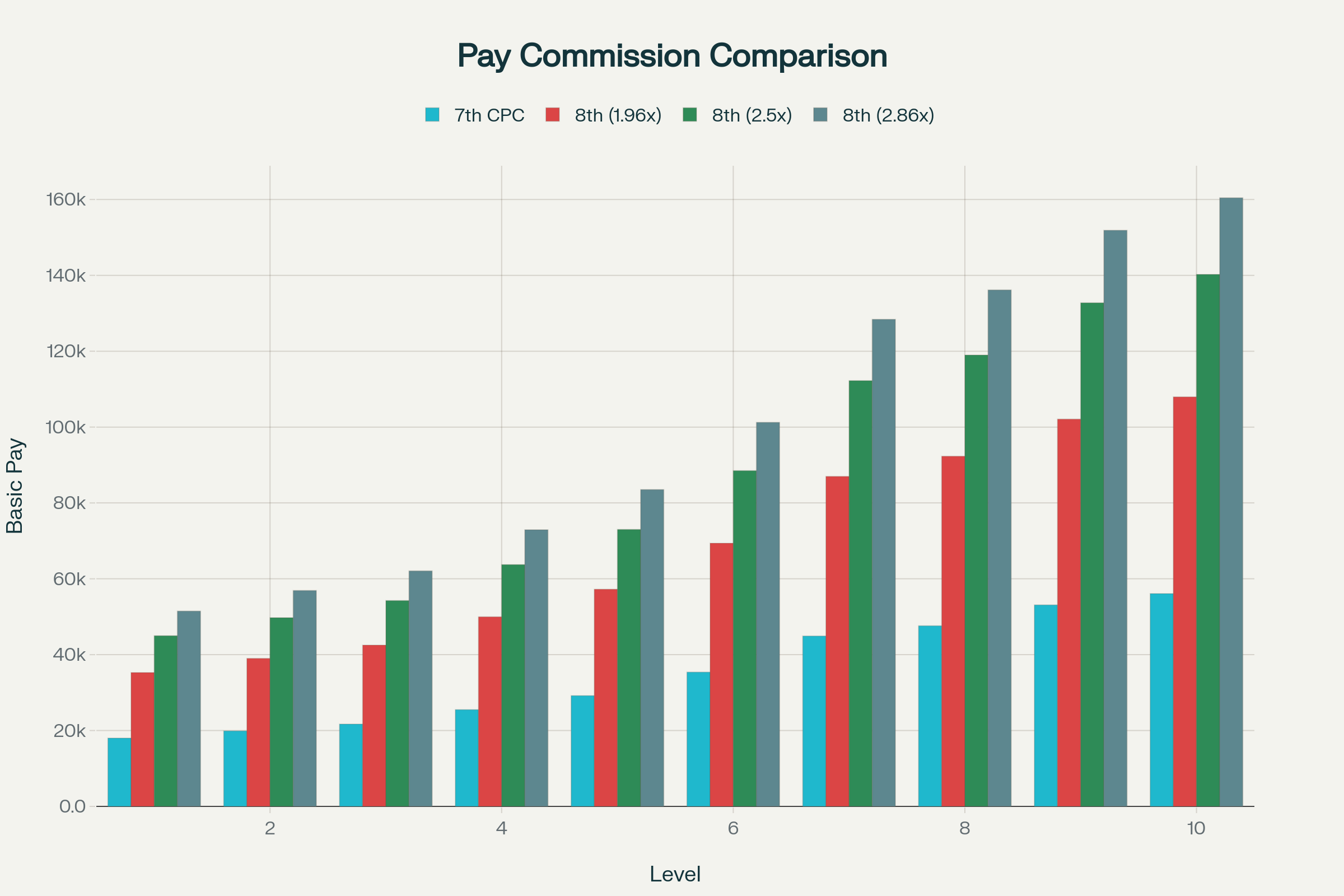

Expected Revised Pay Table (Levels 1–10)

| Pay Level | 7th CPC Basic Pay (₹) |

8th CPC Basic Pay (1.96x, ₹) |

8th CPC Basic Pay (2.5x, ₹) |

8th CPC Basic Pay (2.86x, ₹) |

|---|---|---|---|---|

| 1 | 18,000 | 35,280 | 45,000 | 51,480 |

| 2 | 19,900 | 39,004 | 49,750 | 56,914 |

| 3 | 21,700 | 42,532 | 54,250 | 62,062 |

| 4 | 25,500 | 49,980 | 63,750 | 72,930 |

| 5 | 29,200 | 57,232 | 73,000 | 83,512 |

| 6 | 35,400 | 69,384 | 88,500 | 101,244 |

| 7 | 44,900 | 87,004 | 112,250 | 128,414 |

| 8 | 47,600 | 92,296 | 119,000 | 136,136 |

| 9 | 53,100 | 102,076 | 132,750 | 151,866 |

| 10 | 56,100 | 107,956 | 140,250 | 160,446 |

Expected Basic Pay Chart: 7th vs 8th Pay Commission

Frequently Asked Questions (FAQs)

- When will the revised salaries be implemented? The new pay scales are expected to come into effect from 1st January 2026.

- Who is covered under the 8th Pay Commission? All central government employees, with pending advocacy for including all pensioners.

- How is the revised basic pay calculated? Multiply current basic pay by the fitment factor (likely 1.96–2.86).

- Will the allowances also increase? Yes, HRA and DA will be recalculated as per new basic pay.

- What about state government employees? Each state decides its own implementation timeline after central government declaration.

Disclaimer: All figures are projections based on available news. The Government of India will finalize and notify the pay matrix and allowances after the 8th CPC submits its report.